Benchmarking Survey: Can we reduce procurement time in HEOR & RWE?

November 6, 2018

As healthcare moves towards an increased focus on outcomes and value, health economics & outcomes research (HEOR) and real-world evidence (RWE) are being used to guide value-based decisions, improve outcomes, reduce costs, and achieve market access. This move toward new ways of defining value has led to growth in the number and complexity of HEOR and RWE initiatives as well as increased diversity in the types of stakeholders involved in them.

Outsourcing of HEOR & RWE is increasing

As a result of expansion in HEOR/RWE initiatives, many companies are outsourcing to keep up. A 2017 survey conducted by ISR Reports found that companies outsource an average of 75% of their HEOR work, a trend driven by limited internal resources, lack of time, and the need to foster great credibility by using trusted third-party partners.1

To better understand the challenges and opportunities in the procurement and contracting of HEOR/RWE projects, HealthEconomics.Com and Scientist.com conducted an online survey of researchers and suppliers in HEOR, RWE and related areas with over 150 respondents. The HEOR and RWE Sourcing and Procurement Challenges and Opportunities Benchmarking Survey represented a wide variety of companies including biopharma/medical device (35%), research consultancies including CROs (37%), private payers/pharmacy benefit management companies (5%), and academia (7%). Forty percent of respondents were from large organizations with 1,000 or more employees. About one-third (31%) categorized themselves as a buyer of services, 38% were a supplier, and 25% were both a buyer and a supplier.

Consistent with the ISR survey1, the HealthEconomics.Com and Scientist.com benchmarking survey showed that three-fourths (71%) of respondents outsource one-half or more of their work.

Contracting time is a challenge in HEOR & RWE procurement

One of the most serious stumbling blocks identified was long contracting times.

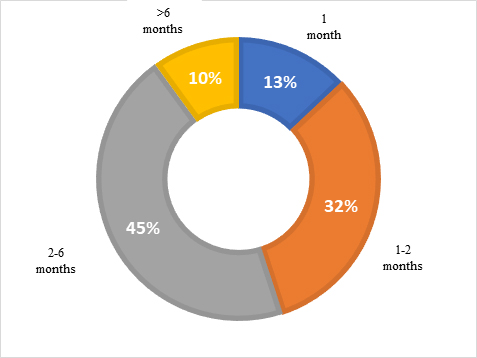

More than one-half (55%) of HEOR/RWE professionals found that average contracting time exceeded 2 months and 10% found that it exceeded 6 months.

Consequences of long contracting time

Long contracting times delay insights, impede market access, hinder decision-making by providers and payers, and may result in increased costs of drug development and commercialization. Ultimately, this leads to delays in how quickly an intervention gets to the patient. As one Medical Affairs professional from a consulting company put it: “[Procurement] takes a very long time, making [study] results less meaningful”.

Need for standardization

Many respondents grappled with overly complex administrative and legal processes during the HEOR/RWE sourcing and procurement process. Eighty percent of respondents (both buyers and suppliers) agreed that buyer requirements are not standardized. This finding was echoed by an editorial in Clinical Leader, stating, “HEOR procurement can be intricate due to the lack of standardized requirements and regulations.”2 This results in a longer period in the negotiation and set up phase of contracting before the actual work can even begin.

While both suppliers and buyers identified a more standardized and expedited contracting process as a major need, there were key differences in how their comments approached the issue.

Suppliers focused on problems with buyer processes with 8 out of 10 agreeing that it is difficult to navigate through the buyer’s procurement process. Seventy percent agreed that buyer compliance requirements hinder successful contracting.

Buyers focused on the time spent working with their own internal procurement team. A Director of Outcomes Research from a pharmaceutical company said that, “…timelines certainly are [affected] when having to jump through hoops to demonstrate why one supplier is needed over another”. Indeed, over 60% agreed that it is challenging to compare suppliers for a project.

A solution that simplifies administrative and legal requirements while allowing buyers to easily differentiate suppliers is clearly needed.

A marketplace solution for sourcing challenges

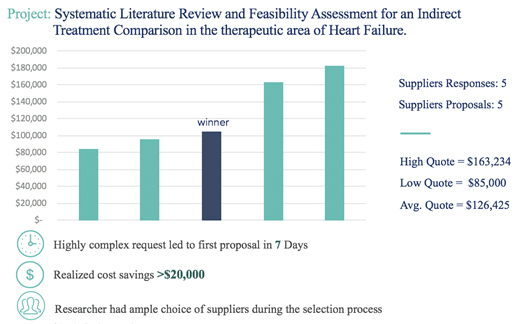

Scientist.Com, the world’s leader in scientific services marketplaces connecting buyers and suppliers, found that an online marketplace approach improved contracting time and saved money. As shown in the figure below, the online marketplace resulted in a first proposal within 7 days of a highly complex request, provided for easy comparison of 5 different suppliers, and resulted in a realized cost savings of >$20,000. Applying this approach to HEOR and RWE could result in a similarly expedited contracting process and the potential for cost savings.

[source: Scientist.Com data on file]

HealthEconomics.Com and Scientist.com have partnered together to launch the HEOR & RWE Marketplace, an online solution that accelerates the sourcing and procurement process for researchers and suppliers of HEOR, RWE and market access services.3 By streamlining the process for buyers and sellers, the HEOR & RWE Marketplace will deliver reduced time to contract, quicker time to insight, and faster market access, while saving costs.

The HEOR & RWE Marketplace

Powered by two trusted life science brands

The HEOR & RWE Marketplace is comprised of a global network of suppliers with access to a host of data sources, and placing an order is simple:

- Researcher places a request

- The details of the request are sent to several qualified suppliers

- Researcher receives responses within days

- An experienced Research ConciergeTM team quickly narrows the pool of eligible suppliers

- Researcher receives proposals to compare

- Researcher selects the best one for the particular study

- Researcher receives requested services upon internal approval and completed PO

As HEOR and RWE are increasingly required by payers and providers, outsourcing and procurement are critically important to the research process of evidence development. It is imperative that administrative, sourcing, and legal hurdles do not prevent much needed interventions from reaching patients. Solutions like a marketplace approach should be fully evaluated in terms of their ability to simplify procurement, reduce time to contract, deliver quicker time to insight and facilitate faster market access, while saving costs.

References:

- ISR Reports. Benchmarking the Pharma Industry’s HEOR Function. (2017). Available at: https://www.isrreports.com/wp-content/uploads/woocommerce_uploads/2017/09/2017-Benchmarking-the-Pharma-Industrys-HEOR-Function-2nd-Edition-Enterprise.pdf.

- Parikh, H. An Overview Of Offshoring HEOR. Clinical Leader (2015). Available at: https://www.clinicalleader.com/doc/an-overview-of-offshoring-heor-0001.

- HealthEconomics.Com, Scientist.Com Partner on RWE/HEOR Initiative. HealthEconomics.Com (2018). Available at: https://healtheconomics.com/industry-news/healtheconomics-com-scientist-com-partner-on-rwe-heor-initiative.