The future of market access: a new model for the ‘next normal’

October 13, 2021

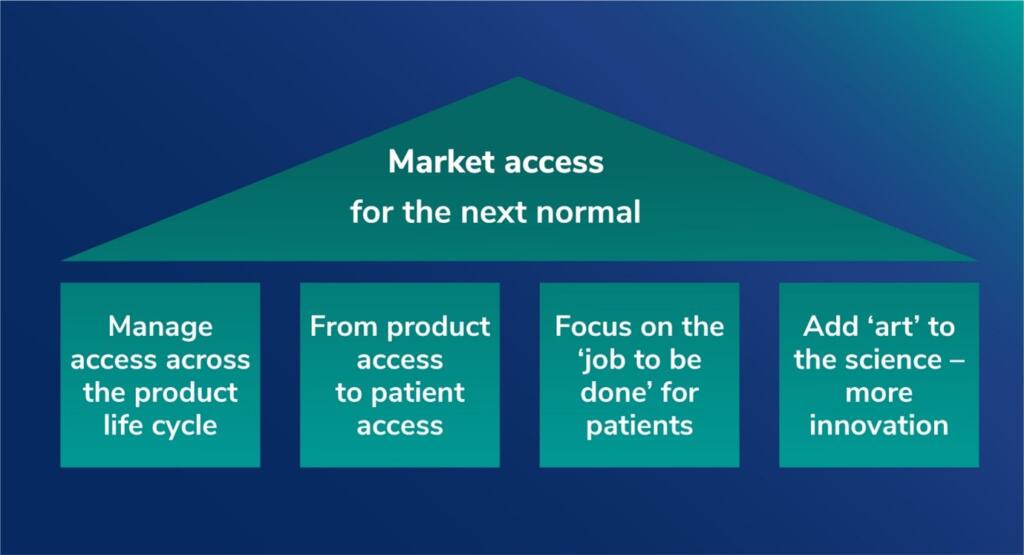

The new model of access strategy should build around four key pillars, says Jeff Weisel, Senior Advisor Asia-Pacific, PRMA Consulting. In this update, Jeff explores why the shifting currents of global healthcare are dictating a new approach to market access.

Just over three years ago, I published an article on “Rethinking Access” in which I set out some perspectives on how the changes under way in the biopharmaceutical industry would impact the way that companies addressed market access going forward.

Given all that has transpired since that time, especially for an industry at the center of the response to the global COVID-19 pandemic, it is a good moment to revisit some of the themes from that article, see how the approach to access has evolved, and explore why a new approach to access should be built on four pillars of:

- Driving access and value across the product life cycle

- Shifting emphasis from product access to patient access (and outcomes)

- Focusing on the ‘job to be done’ – not the organization chart

- Adding ‘art’ to the science – embracing digital and business model innovation.

Back to the future: the evolution of market access

To understand the future of market access, we must first circle back to its origins and how it has evolved to the present day. Market access emerged as an integrated function in most biopharmaceutical companies in the early 2000s as a response to the increasingly central role of the payer in healthcare systems. The focus was on securing reimbursement for new medicines at a commercially attractive price with broad treatment guidelines in a reasonable timeframe. This objective was (and still is) mostly accomplished by submitting formal dossiers to national insurance agencies and managed care organizations for reimbursement approval using cost-benefit models that utilized health economics analysis.

This new approach was largely successful in an environment still dominated by mass-market blockbusters in developed markets where the payers had supplanted physicians as the primary drivers of treatment decisions. However, as the environment has changed dramatically in recent years, both internally and externally, drug companies have had to rethink market access as both a strategic objective and an operational activity.

Worlds in collision

However, that world has long since passed. In 2018, a structural revolution was already well under way as most of the traditional primary care blockbusters had already fallen over the ‘patent cliff’. These products targeted large patient populations at relatively low prices and, as they went generic, payers shifted expenditure to newer therapies. Since that time, a number of companies have since restructured their businesses to align with their portfolios by divesting (AstraZeneca, Takeda) or spinning off their established primary care products into new companies (Pfizer, MSD), thereby sharpening their focus on their new innovations.

The second driver of this shift was the scientific revolution started by the mapping of the human genome. The market was increasingly dominated by therapies targeting specific disease pathways that serve much smaller patient populations, and this trend has accelerated since then as evidenced by FDA approvals over the past few years and going forward.

The third broader trend observed was that the R&D process, especially the scope and timelines of clinical development, hadn’t yet changed significantly over many years and this was partly driven by a regulatory pathway that still required large, lengthy trials. The result was that bringing a new drug to market still means an investment of more than $2 billion. The past few years have seen some change in this dynamic, reflecting the nature of many of the new therapies. As drug candidates become more targeted, the risks of failure in early stages get reduced, while the focus on treating unserved patient populations has speeded up the clinical development and regulatory process under various accelerated schemes offered by the FDA and other agencies. Since early 2020, the remarkably fast development of the various COVID-19 vaccines, especially the new mRNA technology, has provided a glimpse of how these processes might be further streamlined in the future. At this point, however, the impact on drug development investment levels has not yet come through in a meaningful way.

The resulting combination of therapies with small target populations and high levels of investment together with shareholder pressure to replace revenue from old blockbusters has led to much higher drug prices with new treatments frequently topping $100,000 and beyond.

It is this new model that is crashing headlong into a payer agenda focused on cost containment and measurable value. Payers around the world are struggling to cope with pressures from aging populations and epidemics in chronic diseases and cancer as well as financial and political constraints on budgets. The COVID-19 pandemic has put further strain on healthcare systems and brought communicable diseases back to the top of government agendas. The key question then centers on the sustainability of a model based on small populations and higher prices.

Medical miracles – but at a cost

The original article was published soon after the approval of Novartis’ Kymriah as the first CAR-T gene therapy to come to market. These therapies represent a fundamental breakthrough in clinical value and, in many cases, are truly lifesaving. Even at the initial price of $475,000, it still demonstrated cost-effectiveness in treating patients who previously had few options. The oncoming wave of cell and gene therapies – with price levels in the hundreds of thousands of dollars – is driving a redefinition by leading payers about their priorities beyond just cost-effectiveness models. New thinking is evolving on how to evaluate treatment outcomes; when and how to pay for treatments (as well as how much); and even whether these therapies should be funded as medicines or as clinical procedures.

Payers with more limited resources may also need to consider the budget impact and opportunity cost of funding such breakthrough products. For example, for the same cost as providing a CAR-T therapy that saves the life of one patient, hundreds of children could receive a full childhood immunization schedule through their teen years. These sort of allocation decisions are increasingly becoming a factor, particularly in emerging markets with resource constraints and where the healthcare financing model is still a work in progress. The impact of COVID-19 has shown that even rich countries can be forced into painful trade-off decisions in allocating scarce resources.

Brave New World

Breakthrough treatments such as Kymriah are coming to market in a time of a broader transformation driven by technology. Some of these changes were already well under way in 2018 and have been accelerated by the global pandemic.

For example, apps on mobile phones and wearable devices such as smart watches are already enabling patients to take control of managing their own health as engaged and informed consumers. The pandemic drove many patients to access healthcare on telemedicine platforms that spanned a full consultation experience from diagnosis to prescription to payment to delivery, particularly in China where platforms such as WeDoctor (owned by Tencent, which also owns WeChat) are serving millions of patients every month.

At the same time, medical devices and diagnostics equipment are becoming smaller, cheaper, and digital, expanding patient care beyond the hospital walls. On the diagnostics side, the urgency of containing COVID-19 is driving rapid advances in the accurate detection and efficient delivery of the analysis to enable better clinical decisions. Companion diagnostics, such as the recent collaboration between Guardant Health and Janssen in lung cancer, are increasingly part of the value package presented to payers as well as clinicians.

Digital therapeutics – or therapies based solely on software – are now quickly emerging with the first FDA approval in late 2018 for reSET, a treatment for substance abuse disorder from Pear Therapeutics. These new therapies are being prescribed alongside and as alternatives to physical medicines and will increasingly be considered by payers in the same way.

These trends are now converging as mobile phones increasingly take on the role of diagnostic and treatment platforms for a variety of conditions, while they connect with medical devices through the Cloud. From a market access perspective, these trends are bringing an explosion of real-world data to be assessed for value.

A new model for the even newer normal

The basics of pricing, reimbursement, and time to market are still critically important – but no longer sufficient to meet the changes in the industry and the broader healthcare market environment. So how can we redefine the access model and repurpose it to meet the challenges arising over the next decade? The new model of access strategy should build around four key pillars… continue reading to see the four key pillars of market access